Inflation Reduction Act of 2022

Make sure you hire a Certified Public Accountant (CPA), not just an accountant. The Inflation Reduction Act allocates 45.6 billion to the IRS for Enforcement.

Lien, Levy, Seize, Bring them to their knees! Every business should invest in a good financial and tax advisor no matter how large the business. A CPA can represent you at a tax audit, they can assist with business decisions, and offer quarterly reviews of your business!

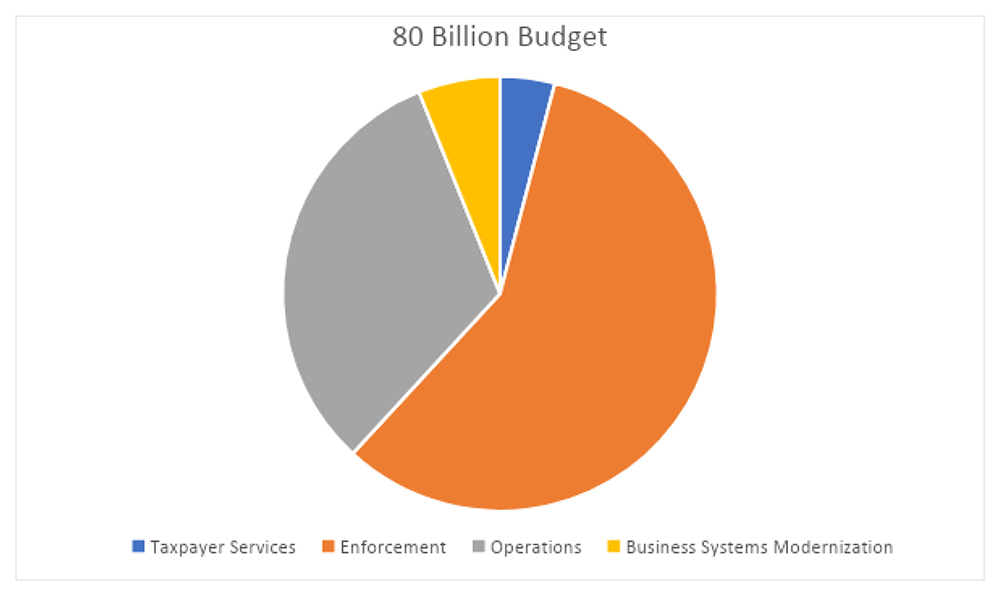

The Inflation Reduction Act Section 10301 sets aside 80 billion to the Internal Revenue Service to add auditors, automate technology, and increase customer service. The bill is designed to enhance the IRS and strengthen tax collecting. The bill targets high income wage earners and corporations. The aim is to relieve the burden from the low-income wage earners. However, by IRS statics more than half of the IRS’s exams in 2021 were low-income wage earners under $75,000. Another twenty-six percent of exams were on wage earners between $75,000-$200,000. So only time will tell if that will be the case. That is why every business no matter the size needs to be sure to invest in a good financial and tax advisor.

The Inflation Reduction Act will allocate 57% or 45.6 billion dollars for enforcement that is expected to generate $4.50 dollars for every dollar spent on enforcement. This translates to over 100 billion in revenue to the IRS in the next 10 years. If you need financial or tax advice do not hesitate to contact Dyer & Associates CPA, PLLC at www.dyer-cpa.com.

https://www.washingtonpost.com/business/2022/08/06/inflation-reduction-act