Running a small business, comes with its challenges, especially when it comes to bookkeeping and accounting. We at Dyer & Associates CPA, PLLC is here to illuminate the numerous benefits of outsourcing these essential services. In this blog, we will list some benefits of outsourcing small business and accounting services.

Blog & Newsletter by Dyer & Associates CPA, PLLC

-

The Benefits of Outsourcing Your Small Business Bookkeeping and Accounting Services

CLICK HERE TO READ THE FULL ARTICLE »

-

Understanding the Role of a CPA in Your Business

Whether you're a seasoned entrepreneur, a startup founder, or simply someone eager to gain insights into effective financial management, understanding how a CPA can benefit your business is essential. In this blog, we'll unravel the various aspects of a CPA's expertise, shedding light on how their skills and guidance can be a game-changer for your financial success.

CLICK HERE TO READ THE FULL ARTICLE »

-

The Importance of Keeping Accurate Financial Records for Your Small Business

In the world of business, accuracy is paramount, especially when it comes to financial records. For small businesses, this is not just a good practice – it's a necessity. At Dyer & Associates CPA, PLLC, we understand the significance of meticulous financial record-keeping, and in this blog, we'll delve into why it's crucial for your business's success.

CLICK HERE TO READ THE FULL ARTICLE »

-

The Benefits of Outsourcing Your Small Business Bookkeeping and Accounting Services

Running a small business is like juggling a multitude of tasks, from managing employees to satisfying customers' demands. In the midst of it all, there's one critical aspect that often gets overlooked: bookkeeping and accounting. It's easy to get caught up in the daily operations and let those piles of receipts and financial statements pile up on your desk. But fear not, for there's a solution that can alleviate this burden and bring peace to your entrepreneurial journey: outsourcing your business bookkeeping and accounting services.

CLICK HERE TO READ THE FULL ARTICLE »

-

Unveiling the Hidden Benefits: Employee Retention Credit Opportunities for Your Business

In the fast-paced world of business, it's essential to stay informed about the latest tax credits and incentives that can help your company thrive. As an accountant, tax preparer, or financial advisor, you know the importance of identifying opportunities that can benefit your clients. Today, we'll be shedding light on the often-overlooked Employee Retention Credit (ERC) opportunities that can significantly impact your clients' financial landscape. So let's dive in and explore how this tax credit can help boost their businesses in Hernando, MS, and beyond.

CLICK HERE TO READ THE FULL ARTICLE »

-

Understanding the Role of a CPA: Certified Public Accounting, in Your Business

Running a business can feel like a wild roller coaster ride at times, with twists, turns, and unexpected loops. Amidst all the chaos, there's one professional who can bring order to the financial chaos and ensure your business stays on track: the Certified Public Accountant (CPA). This financial superhero possesses the expertise, skills, and knowledge to navigate the complex world of numbers and regulations, making them an invaluable asset to any business.

CLICK HERE TO READ THE FULL ARTICLE »

-

The Importance of Keeping Accurate Financial Records for Your Small Business

In the dynamic realm of small businesses, where every decision holds weight and each dollar can determine success or failure, a vital factor emerges—an essence of prosperity, if you will. And at the core of this pivotal element lies an imperative: maintaining precise financial records. Much like a treasure map leading to profitability, these diligently upheld records possess the ability to shape a small business into a soaring triumph or leave it adrift in a sea of uncertainty. From tracking expenses to preparing tax returns, reliable financial records provide crucial insights into your business's financial health and help you make informed decisions.

CLICK HERE TO READ THE FULL ARTICLE »

-

Employee Retention Credit

Dyer & Associates CPA, PLLC is reviewing Employee Retention Credit claims for businesses affected by Covid. In order to be impacted by Covid your business had to have a government order to shut down or a drop in gross receipts during 2020 or 2021 compared to 2019.

Examples of eligibility include but are not limited to (1) gross receipts drop per quarter in 2020 by 50% or 20% in 2021 compared to 2019. (2) Supply chain disruptions due to government order and inability to get parts or materials to perform work or continue manufacturing. (3) Government orders to cut back on hours of operation or limitations on group meetings or gatherings that affect business.

If you feel you may be entitled to the Employee Retention Credit, contact us today to help you apply for the credits and help evaluate your claim. Contact us at info@dyer-cpa.com and request our Employee Retention Credit questionnaire for your evaluation.

CLICK HERE TO READ THE FULL ARTICLE »

-

DYER CPA Tax Season 2023

The new tax year is here and here are some of the changes for 2023.

Business Tax Returns - due by March 15, 2023

CLICK HERE TO READ THE FULL ARTICLE »

-

Inflation Reduction Act of 2022

Make sure you hire a Certified Public Accountant (CPA), not just an accountant. The Inflation Reduction Act allocates 45.6 billion to the IRS for Enforcement.

Lien, Levy, Seize, Bring them to their knees! Every business should invest in a good financial and tax advisor no matter how large the business. A CPA can represent you at a tax audit, they can assist with business decisions, and offer quarterly reviews of your business!

CLICK HERE TO READ THE FULL ARTICLE »

-

Employee Retention Tax Credit Offered By Dyer & Associates CPA, PLLC

At Dyer & Associates CPA, PLLC, we are helping businesses analyze, record, and document the Employee Retention Tax Credit so that they comply with the IRS and take advantage of the credit Congress enacted to help businesses during the pandemic. This is a refundable tax credit against a portion of the Social Security tax equal to fifty percent of wages paid to your employees on or after March 12, 2020 to December 31, 2020. This percentage increased to seventy percent in 2021.

CLICK HERE TO READ THE FULL ARTICLE »

-

Dyer and Associates will be a part of the Small Business Financial & Credit Basics event on the 29th of July

Visit our website for more information

CLICK HERE TO READ THE FULL ARTICLE »

-

Frequently Asked Questions About Tax Returns

Tax preparation and filing are things both individuals and companies often find a challenge. While some of us have the knowledge and skills to maintain our monthly accounts, we often need assistance arranging our receipts, preparing our documents, and planning to ensure we save our hard-earned money.

CLICK HERE TO READ THE FULL ARTICLE »

-

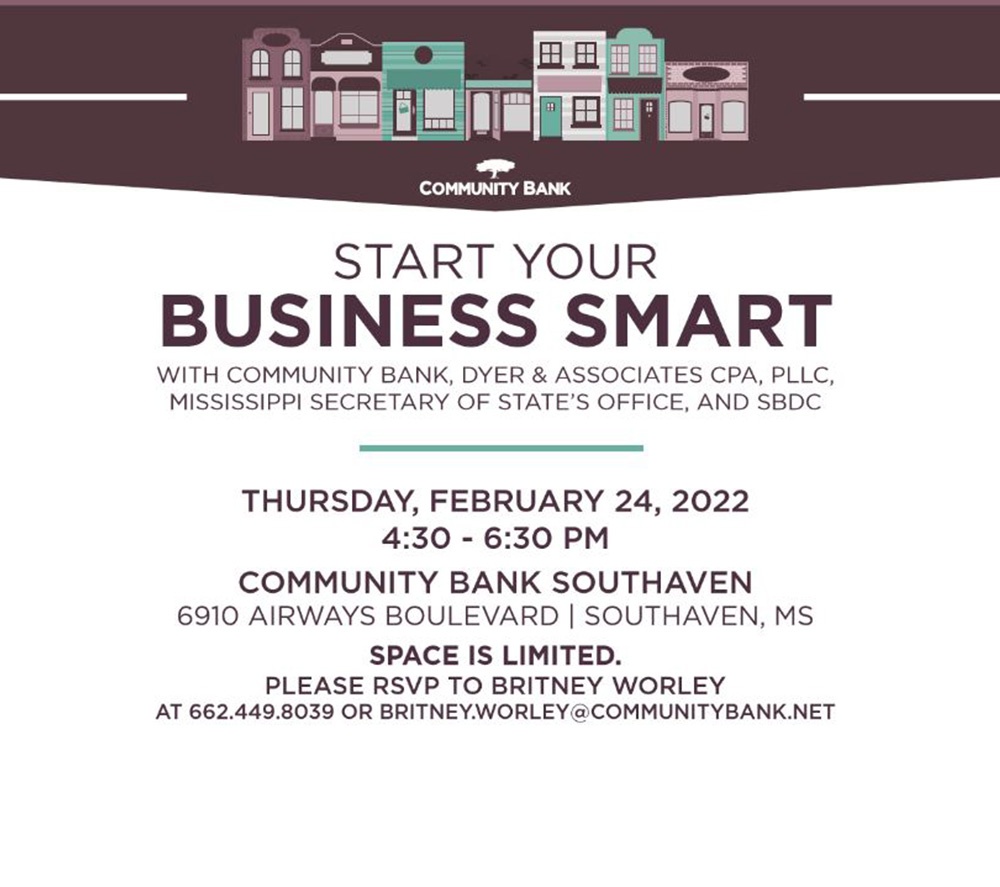

Start Your Business Smart With Dyer & Associates CPA, PLLC

The entrepreneurial spirit burns bright in many people, still not everyone finds the right way to kick start their business journey and grow and succeed. At Dyer & Associates CPA, PLLC, we want to change that trend, which is why we have partnered with a couple of esteemed organizations to create a special community outreach program called - Start Your Business Smart.

CLICK HERE TO READ THE FULL ARTICLE »

-

Common Mistakes Small Businesses Make On Their Tax Return

Starting your own business is hard work. Besides building your core product or service, you also need to have operational knowledge of numerous other facets of the company. In the early stages of your small business, hiring additional staff or even contractors to manage some of these roles may not be an option. In such a situation, you are faced with the intimidating task of having to learn as much as possible in a short period. As such, it is possible to make mistakes due to a lack of experience and expertise, especially regarding the more technical aspects such as accounting and tax.

CLICK HERE TO READ THE FULL ARTICLE »

-

Top Five Things To Look For When Hiring An Accountant

An accountant is responsible for preparing accounts and tax returns, administering payrolls, controlling income and expenditure, auditing financial information, and compiling reports. Similarly, a CPA (Certified Public Accountant) prepares audited or reviewed financial statements and files reports with the Securities and Exchange Commission (SEC). Hiring a CPA also comes with the benefit of IRS (Internal Revenue Service) representation.

CLICK HERE TO READ THE FULL ARTICLE »

-

What Makes Dyer & Associates CPA, PLLC Stand Out

Thanks for stopping by our blog. If you’re looking for more information about Dyer & Associates CPA, PLLC, you’ve come to the right place.

CLICK HERE TO READ THE FULL ARTICLE »

-

Meet The Faces Behind Dyer & Associates CPA, PLLC

We are Jason and Penny Dyer, the proud owners of Dyer & Associates CPA, PLLC. We look forward to sharing our story and hope that you will enjoy getting to know us better.

CLICK HERE TO READ THE FULL ARTICLE »

-

Announcing The New Website

We are delighted to announce the launch of our new website!

CLICK HERE TO READ THE FULL ARTICLE »

-

New Website Under Construction

New Website Coming Soon!

CLICK HERE TO READ THE FULL ARTICLE »